Criminal complaint filed with CBI for corruption and criminal conspiracy

63 moons technologies limited (formerly known as FTIL) has been facing continuous targeted and mala fide actions in the wake of a payment default crisis at one of its subsidiaries, the National Spot Exchange Limited (NSEL).

Despite the fact that there is no money trail traced to NSEL, 63 moons and its founder, by multiple investigative agencies, the group has been singularly targeted as part of a conspiracy. On account of these malicious actions perpetrated against the company, a damage of Rs 10,000 crore has been caused to its shareholders.

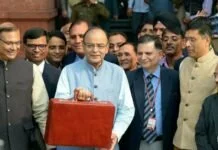

Mr Venkat Chary, Chairman, 63 moons technologies, said that the company has taken serious note of the role played by three individuals, namely, Mr P Chidambaram, the then Finance Minister, Mr K P Krishnan, the then additional secretary, Ministry of Finance, and Mr Ramesh Abhishek, the then Chairman of the Forwards Markets Commission (FMC), and firmly believes about their proactive roles in perpetrating the crisis, – destroying the exchange ecosystem created by the company in order to favour the competitor, viz., National Stock Exchange (NSE), resulting in a huge damage to the shareholders of 63 moons technologies, loss of employment and incomes in the economy.

As a result, the company has decided to file damage suits of Rs 10,000 crore against Mr P Chidambaram and others, in their individual capacities for taking mala fide actions against 63 moons by abusing their powers. Notably, the company has already filed criminal complaints against these three individuals with the CBI along with supporting materials. Curiously they did not come forward to participate in an open public debate that 63moons offered on 4 August 2018 to bring out the truth.

Role played by Mr Ramesh Abhishek, the then Chairman, FMC

Much before the SFIO report, the FMC was aware of the role of the brokers and traders. It however acted in a partisan manner only against NSEL and its parent company. For example, the FMC was mandated under the law to communicate information relating to illegal forward trading to police authorities. However no such information was forwarded by the FMC against the brokers and the traders. Thus, there was a clear dereliction of duty and misuse of official position on the part of the then FMC chairman, Ramesh Abhishek, in selectively targeting the parent company of NSEL, despite no money-trail to them.

Role played by Mr P. Chidambaram and Mr K P Krishnan

The sequence of events and the evidence that has surfaced so far also shows that the then Finance Minister P. Chidambaram and K. P. Krishnan had played a dubious role in destroying the ecosystem created by 63 moons technologies to favour the competitor NSE. A case in point is the note of K. P. Krishnan approved by P. Chidambaram forcing other co-promoters of NCDEX to sell their stake to make NSE a lead promoter clearly revealing their mala fide interference in the competition within the exchange industry.

This hounding of the 63 moons technologies group has not only caused serious loss to its investors but has done irreversible damage to the entire exchange eco-system, the existing jobs and creation of new jobs.

Revelations of SFIO investigation

Recently, the press has reported about the investigation conducted by the Serious Fraud Investigation Office (SFIO) and the sanction granted by the government to prosecute NSEL, its parent company, and its brokers. In the wake of this, the company feels the need to clarify the following facts:

Investigation in NSEL matter not new

It is well-known that the investigation against the NSEL and its parent company had started as early as September 2013 by the Economic Offences Wing, Central Bureau of Investigation and the Enforcement Directorate. Based on the recommendations of the Committee headed by the then Finance Secretary, Arvind Mayaram, the then Finance Minister,

Mr P Chidambaram, had launched multi-agency investigation against the NSEL and its parent company.

The investigation against the NSEL and its parent company is still underway and we have requested Hon’ble court that the investigation is completed expeditiously. From the investigation made so far it has clearly been established that the entire money-trail has been traced to 22 defaulting members of NSEL. Thus, the liability for the default amount has been crystalized. The investigation conducted by SFIO also confirms this fact.

What is new in the SFIO report

The only thing that the SFIO report has done is to put the spotlight on the brokers, the actual defaulters, the traders, and the executive management team of NSEL.