Bank Closures: What’s Happening and How It Affects You

Bank closures can feel scary, especially when you see headlines about a branch shutting its doors. But most of the time, a closure is just a business decision, not a sign that your money is unsafe. In this guide we’ll break down why banks close, what the latest closures in India look like, and the steps you should take to protect your accounts.

Why Do Banks Close Branches?

There are a few common reasons. First, digital banking is booming, so many customers now prefer apps over a physical counter. When foot traffic drops, maintaining a brick‑and‑mortar branch becomes expensive. Second, banks constantly evaluate their network for profit‑ability; a location with low deposits and high costs may be pulled. Third, regulatory changes sometimes force banks to consolidate or restructure, leading to closures in certain regions.

None of these reasons mean the bank itself is failing. Usually the institution remains solid, and your deposits stay insured by the Deposit Insurance and Credit Guarantee Corporation (DICGC) up to ₹5 lakh.

Recent Bank Closures Across India

In the past few months, several regional banks announced the shutdown of under‑performing branches in smaller towns. For example, a north‑east cooperative bank closed three branches in Assam after a dip in local deposits. Meanwhile, a national private bank merged several city‑center locations into a larger hub to streamline operations.

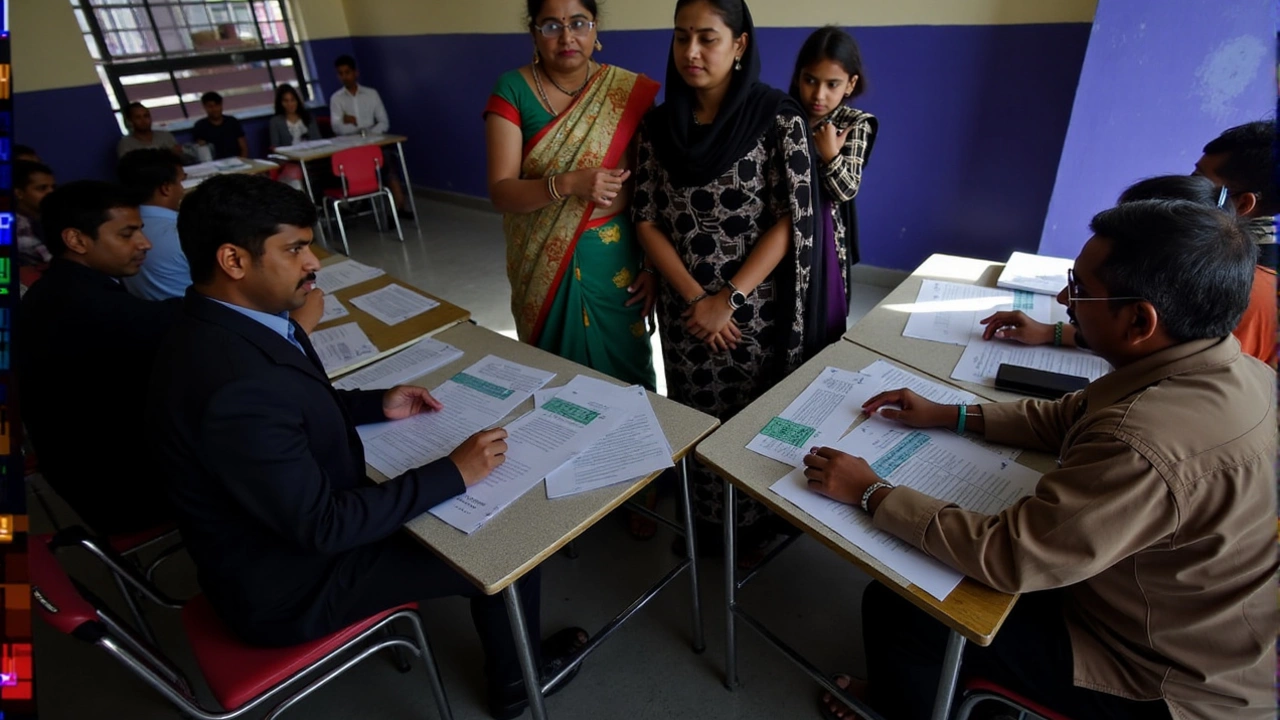

These moves often come with a notice period of 30‑60 days, giving customers time to move their transactions. Banks typically set up temporary counters or mobile vans to help with the transition, and they also update online portals with new branch codes.

If you receive a closure notice, check the bank’s official website or app for the exact date and any nearby alternatives. You can also call the customer care line for guidance on updating your cheque book, auto‑debits, and other services.

What You Should Do When Your Branch Closes

First, verify the closure notice. Scammers sometimes send fake emails to steal your personal info. Always log into the bank’s official site or use the official mobile app to confirm.

Second, update any recurring payments. If you have utility bills, loan EMIs, or subscription fees linked to the old branch account, switch the details to a new branch or use the bank’s digital payment options.

Third, retrieve any cash or documents you need before the final day. Some banks keep a temporary locker or a standby counter for a short period after the official shutdown.

Lastly, consider if you want to stay with the same bank. If the nearest branch is far and you’re uncomfortable with the digital experience, it might be a good time to explore other banks that have a stronger physical presence in your area.

Remember, your money is still safe as long as the bank itself is operating. The closure only changes where you can go for face‑to‑face help.

Tips to Stay Ahead of Future Closures

Subscribe to your bank’s SMS alerts—they’ll send a heads‑up before any branch changes. Keep an eye on the bank’s annual report; it often hints at network rationalisation plans. And maintain a small amount of cash at home for emergencies, just in case you need to make a quick payment before reaching a new branch.

Bank closures are part of the evolving financial landscape. By staying informed and adjusting your habits, you can keep your money secure and your banking smooth, no matter how many doors shut behind you.

Delhi Elections 2025: What's Open, What's Closed on Voting Day

With Delhi's Assembly elections set for February 5, 2025, residents can expect widespread closures, including banks, liquor shops, and cinemas, while educational institutions take a break. Although essential services remain operational, liquor stores face a temporary shutdown. Public holiday mandates aim to boost voter turnout, amplified by early metro and bus operations.